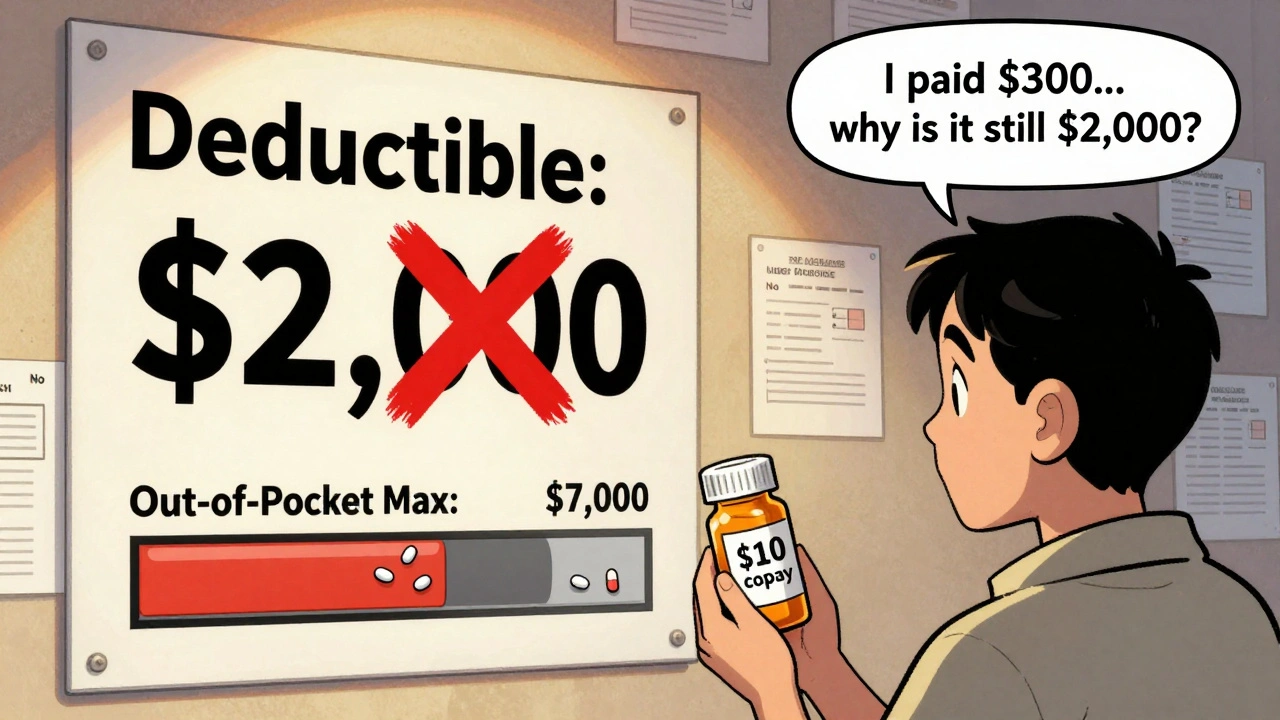

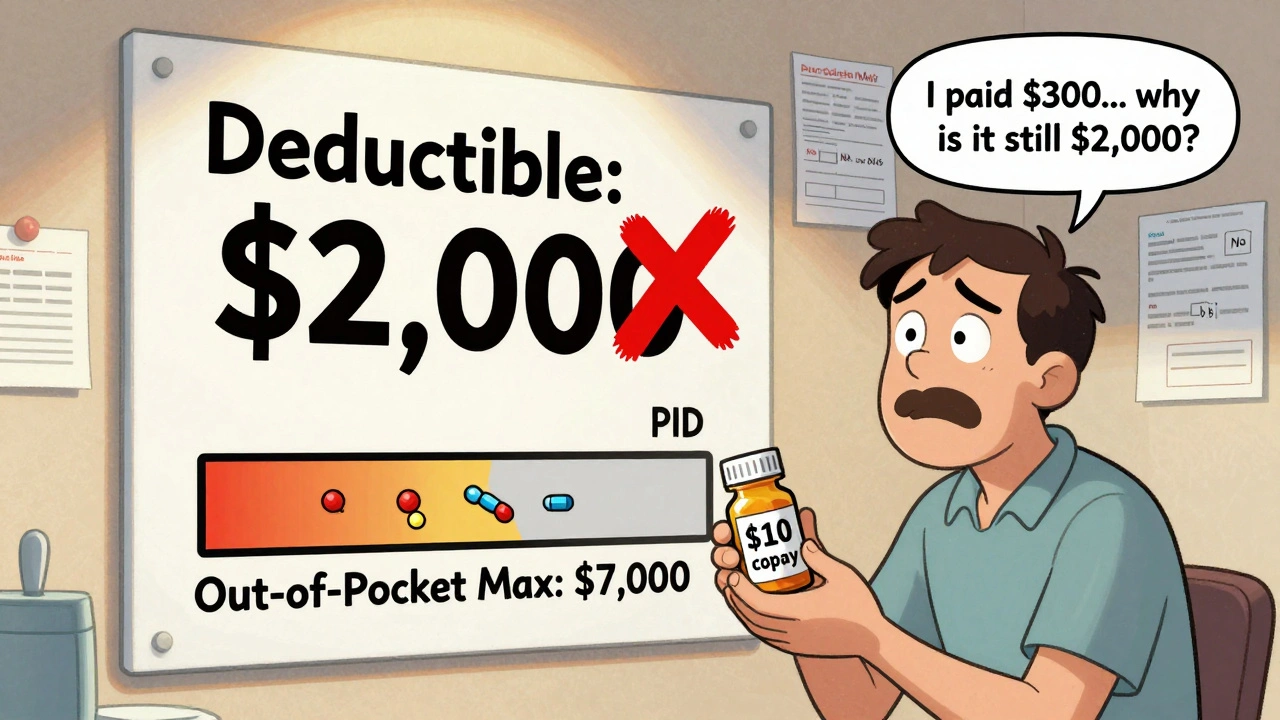

Imagine you take a generic blood pressure pill every day. It costs $10 per prescription. You’ve paid $300 in copays this year already. You think you’re getting closer to meeting your $2,000 deductible-until your insurer says you haven’t met it at all. That’s not a mistake. It’s how most health plans work. And it’s confusing millions of people.

What’s the difference between a deductible and an out-of-pocket maximum?

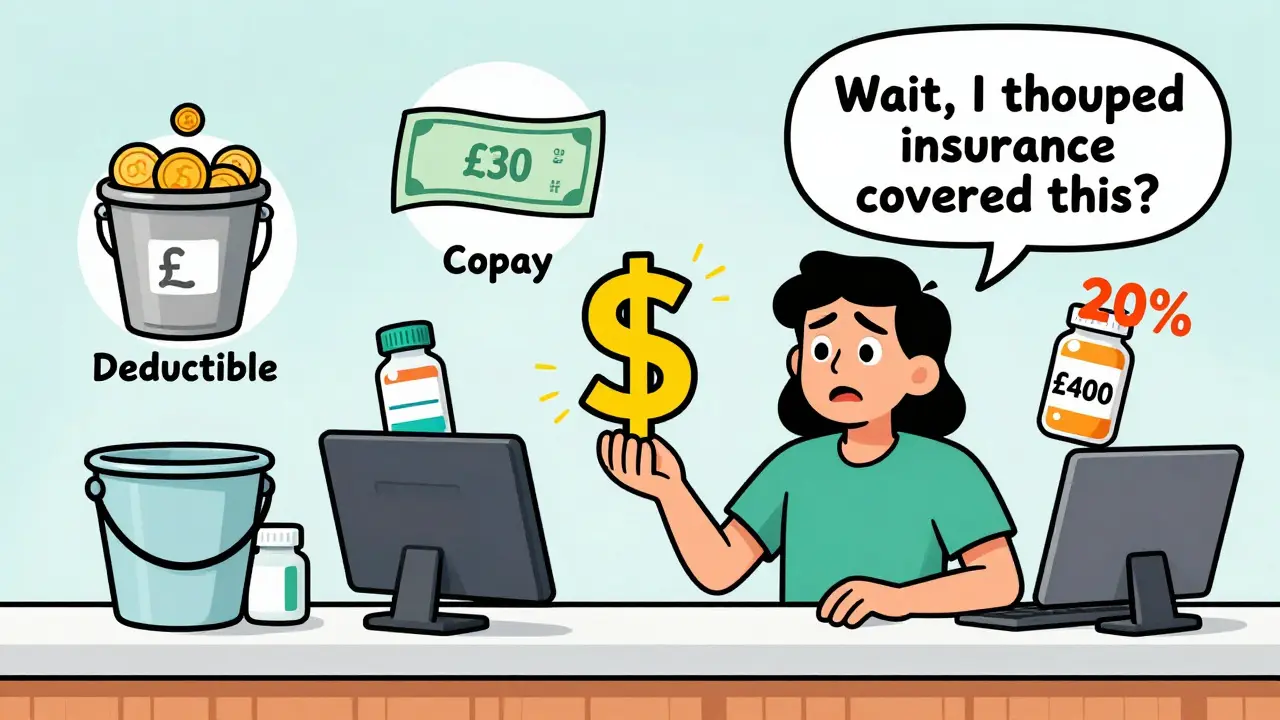

Your deductible is the amount you pay before your insurance starts sharing the cost of most services. If your deductible is $1,500, you pay the first $1,500 of covered care yourself. After that, you usually pay coinsurance-say, 20%-until you hit your out-of-pocket maximum.

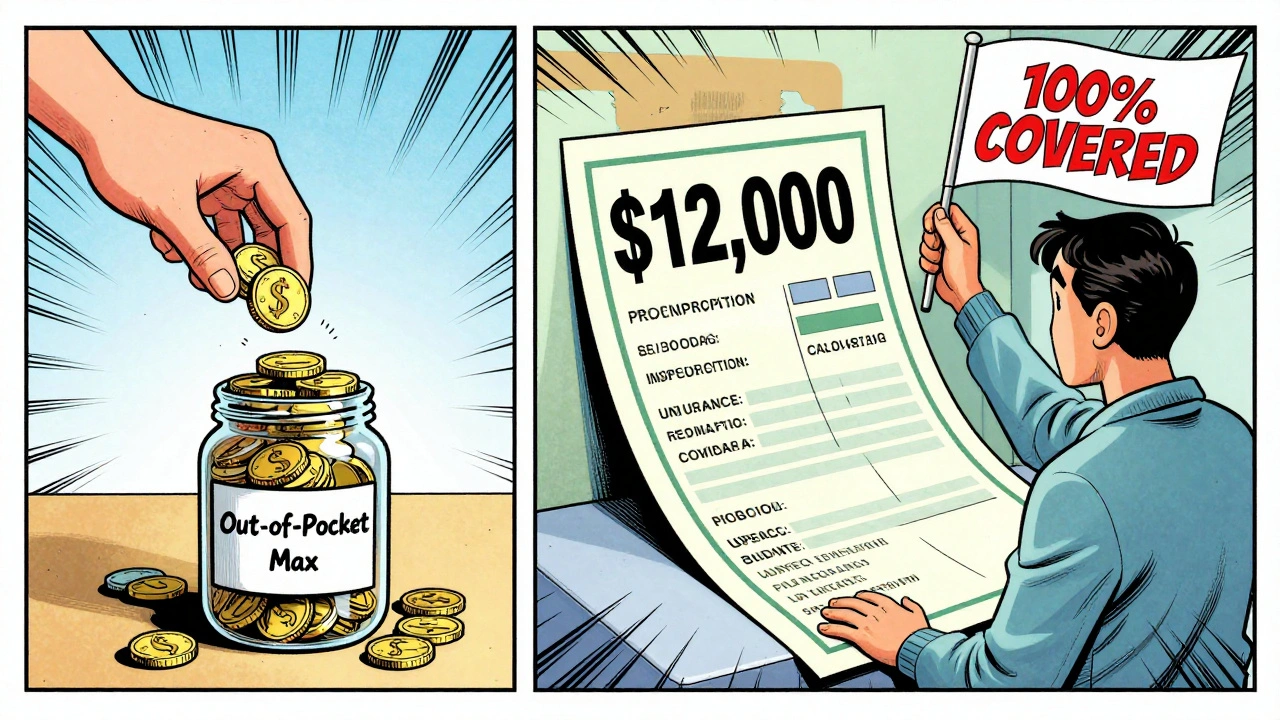

The out-of-pocket maximum is the most you’ll pay in a year for covered services. Once you hit that limit, your insurance pays 100% of everything else. For 2025, the federal cap is $9,200 for an individual and $18,400 for a family. These limits are set by the Department of Health and Human Services and apply to all plans sold under the Affordable Care Act (ACA).

Here’s the catch: generic copays count toward your out-of-pocket maximum, but not toward your deductible. That means every $10 you pay for your medication adds to your total out-of-pocket spending-but doesn’t chip away at your $1,500 deductible. You could pay $5,000 in copays over the year and still owe the full deductible if you need surgery or hospital care.

Why does this system exist?

Before the ACA took full effect in 2014, prescription copays didn’t count toward anything. You paid them, and they vanished from your financial record. People with chronic conditions-diabetes, asthma, high cholesterol-were stuck paying the same copay every month with no progress toward lowering their overall costs. Many skipped doses because they felt like they were throwing money away.

The ACA changed that. It required all insurance plans to count all in-network cost-sharing-deductibles, coinsurance, and copays-toward the out-of-pocket maximum. That was a huge win. Now, if you’re spending hundreds on meds, you’re actually moving closer to having your insurance cover everything else.

But the law didn’t force copays to count toward the deductible. That’s still up to the insurer. Most choose not to. Why? Because it keeps premiums lower. If every copay counted toward the deductible, insurers would have to pay more earlier in the year. So they split the two: deductible for big costs, copays for small, frequent ones.

How do prescription costs work in real plans?

There are three common plan structures you’ll see:

- Single deductible (27% of employer plans): One amount covers both doctor visits and prescriptions. You pay full price for meds until you hit the deductible, then pay coinsurance. No copays here.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles-one for doctor visits, one for prescriptions. You pay full cost for meds until you meet the prescription deductible. After that, you pay a copay, which counts toward your out-of-pocket maximum but not your medical deductible.

- Copay-only (no prescription deductible) (36% of plans): You pay your $10 or $20 copay for every generic prescription right away. These payments count toward your out-of-pocket maximum but not your medical deductible.

Most people end up in #3. It’s the most common in the individual market. And it’s the one that causes the most confusion. You’re paying for meds every month, but your deductible stays stuck at $1,500-even if you’ve spent $4,000 on prescriptions.

What happens when you hit your out-of-pocket maximum?

This is where the system actually helps. Let’s say your out-of-pocket maximum is $7,000. You’ve paid $5,800 in copays for your insulin, blood pressure meds, and asthma inhalers. Then you break your ankle. The hospital bill is $12,000. Your insurance covers 100% of it because you’ve already hit your limit. You pay nothing more for the rest of the year-not even your next prescription.

That’s the point. The out-of-pocket maximum is your safety net. It’s not meant to make you pay less upfront. It’s meant to stop you from going broke if you need major care.

People with chronic conditions often benefit the most. One user on PatientsLikeMe said they reached their $8,500 out-of-pocket max last year and had all their meds free for the last four months. Without the ACA rule, those copays wouldn’t have counted at all.

Why do people get it so wrong?

A 2023 survey by America’s Health Insurance Plans found that 68% of consumers think prescription copays count toward their deductible. Only 22% know they count toward the out-of-pocket maximum.

It’s not your fault. Insurers don’t make it easy. The Summary of Benefits and Coverage (SBC) form is supposed to clarify this, but it’s full of tiny print and confusing labels. Look for the column that says, “Does this payment count toward your deductible?” If it says “No” next to “Generic Prescription Copay,” then it doesn’t.

One Reddit user wrote: “I paid $1,800 in insulin copays last year. Thought I was halfway to my $3,000 deductible. Turns out I still owed the full $3,000 for my knee surgery. I felt like I got scammed.”

That’s not fraud. It’s the structure. But it’s designed poorly for human understanding.

How to avoid being caught off guard

You can’t fix the system. But you can navigate it.

- Check your SBC document. Look for “Prescription Drug Cost-Sharing.” See if copays are listed as counting toward the deductible.

- Call your insurer. Ask: “Do my generic drug copays count toward my deductible?” Don’t trust the website. Ask for a written answer.

- Track your spending. Use a spreadsheet or your insurer’s app. Record every copay, every coinsurance payment, every deductible payment. Add them up monthly.

- Know your out-of-pocket max. If you’re on expensive meds, you might hit it before you need surgery. That’s good.

- During open enrollment, compare plans. Some now offer a single deductible where prescriptions count toward it. These are rarer, but they’re growing.

For 2025, the Department of Health and Human Services is pushing insurers to make this clearer. New rules require plans to highlight in plain language how copays affect your deductible and out-of-pocket maximum. But until then, you have to dig.

What’s changing in the next few years?

There’s pressure to simplify. McKinsey & Company predicts that by 2027, 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because patients are demanding it. And insurers are seeing that confusion leads to skipped meds, ER visits, and higher long-term costs.

The Centers for Medicare & Medicaid Services is testing “Integrated Deductible” plans in five states. Early results show 28% higher medication adherence. That means people take their pills because they know they’re making progress.

But there’s a trade-off. If copays count toward the deductible, premiums might go up 3-5%. Insurers argue that’s the price of simplicity. Consumers argue it’s worth it.

For now, the system stays split. But it’s moving. And if you understand how it works today, you’ll be ready when it changes.

What to do right now

Don’t wait for next year’s open enrollment. Do this today:

- Find your Summary of Benefits and Coverage. It should be in your email or online portal.

- Look for “Prescription Drugs” section.

- Find your generic drug copay amount.

- Check the box next to it: “Counts toward deductible?” If it’s blank or says “No,” then it doesn’t.

- Check the box: “Counts toward out-of-pocket maximum?” If it says “Yes,” then you’re safe-you’re building your protection.

If you’re on multiple prescriptions, add up your yearly copays. If you’re close to your out-of-pocket maximum, you might be one hospital visit away from free care for the rest of the year. That’s powerful.

And if you’re not sure? Call your insurer. Ask for a real person. Say: “I need to understand how my prescription copays work with my deductible and out-of-pocket max.” Don’t let them hang up on you. This is your money.

Do generic drug copays count toward my deductible?

No, in most cases, generic drug copays do not count toward your medical deductible. They are treated separately. Even if you’ve paid hundreds in copays for prescriptions, your deductible may still be untouched. However, these copays almost always count toward your out-of-pocket maximum, which is the real safety net.

Do copays count toward my out-of-pocket maximum?

Yes. All in-network copays-including those for generic prescriptions, doctor visits, and specialist appointments-count toward your out-of-pocket maximum. This is required by the Affordable Care Act. Once you hit your annual limit, your insurance pays 100% of covered services for the rest of the year.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing costs for most services. Your out-of-pocket maximum is the most you’ll pay in a year for covered care-including deductibles, coinsurance, and copays. Once you hit that maximum, your insurance covers everything else. Copays help you reach the maximum, but not the deductible.

Can I reach my out-of-pocket maximum just by paying for prescriptions?

Yes. If you take multiple medications and pay copays every month, you can hit your out-of-pocket maximum before needing any major medical care. For example, if your max is $7,000 and you pay $150/month for insulin and other meds, you’ll hit that limit in under 50 months-or possibly sooner if you have other medical expenses. Once you do, your prescriptions and other care become free for the rest of the year.

What should I look for in my insurance documents?

Look at your Summary of Benefits and Coverage (SBC). Find the section on prescription drugs. Check two things: 1) Does the copay amount have a note saying it counts toward your deductible? If not, it doesn’t. 2) Does it say the copay counts toward your out-of-pocket maximum? If yes, then you’re building protection. Also check if you have a separate prescription deductible-this changes how your costs add up.

Are there plans where generic copays count toward the deductible?

Yes, but they’re still rare. About 27% of employer plans use a single deductible that includes both medical and prescription costs. In these plans, your prescription payments count toward the deductible. These are becoming more common as insurers respond to consumer demand for simpler systems. Check your plan details carefully during open enrollment if this matters to you.

Norene Fulwiler on 5 December 2025, AT 11:36 AM

I used to think my $15 insulin copay was just a tax on being sick. Then I realized it was actually building my safety net. I hit my out-of-pocket max last July and my knee surgery was free. I didn’t even think about it until the bill came and it was $0. That’s the real win here - not the deductible, not the premiums, but the fact that your meds are quietly protecting you from financial ruin.

Stop stressing about the deductible. Focus on the max. That’s where the magic happens.