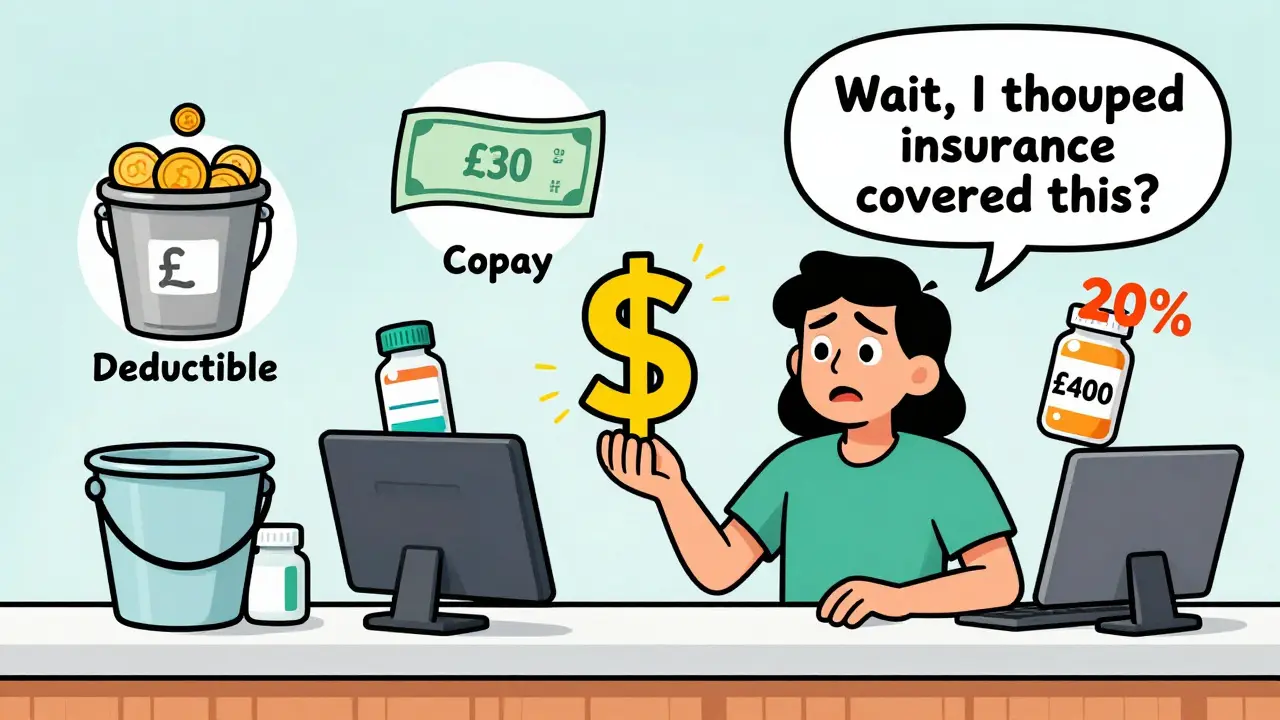

When you pick up your prescription or visit the doctor, you might be handed a bill that says you owe $40. Then next month, you get a bill for $200. You thought your insurance covered this. What happened? The answer lies in cost sharing - the system that splits healthcare costs between you and your insurance company. It’s not complicated, but it’s often explained badly. Let’s cut through the jargon and show you exactly how deductibles, copays, and coinsurance work - especially when it comes to medication costs.

What Is Cost Sharing, Really?

Cost sharing is simply the part of your medical or medication bill you pay yourself. Your insurance doesn’t cover everything. Even if you pay £50 a month for coverage, you still chip in when you get care. That’s by design. Insurance companies use cost sharing to keep premiums lower. If they paid for every single thing, your monthly bill would be much higher. The three main pieces of cost sharing are deductibles, copays, and coinsurance. They don’t work the same way, and they don’t all kick in at the same time. Understanding the difference can save you hundreds - or even thousands - a year.Deductibles: The First Hurdle

Your deductible is the amount you pay out of pocket before your insurance starts helping. Think of it like a bucket. You fill it with your own money until it’s full. Then, and only then, does your insurance start paying its share. For example, if your plan has a £1,500 deductible, you pay 100% of your medical and prescription costs until you’ve spent £1,500 in a year. That includes doctor visits, lab tests, and medications. Even if you take a monthly pill that costs £80, you pay the full £80 until you hit that £1,500 mark. Some plans have separate deductibles for prescriptions. Others combine everything. Check your plan documents. You might be surprised to find your insulin, blood pressure med, or asthma inhaler is hitting the same deductible as your MRI.Copays: Fixed Fees at the Point of Service

A copay is a flat fee you pay when you get care. It’s usually £20 to £40 for a doctor visit, £40 to £60 for a specialist, and £10 to £30 for a generic prescription. You pay this at the pharmacy counter or clinic desk. It’s simple. No calculations. Just pay and walk out. Here’s the catch: copays often don’t count toward your deductible. That means you can pay £20 for five doctor visits (total £100) and still owe £1,400 of your deductible. But here’s the good part: many plans cover preventive care - like annual checkups or flu shots - with $0 copay, even before you meet your deductible. That’s thanks to the Affordable Care Act. For medications, some plans use copays instead of coinsurance. So if your plan has a £15 copay for generic drugs, you pay £15 no matter if the drug costs £20 or £200. That’s a win if you’re on expensive meds. But if your plan uses coinsurance for prescriptions, you could pay £100 for a £500 drug. Know which one you’ve got.Coinsurance: The Percentage Game

Coinsurance kicks in after you’ve met your deductible. It’s not a fixed fee. It’s a percentage. If your plan says 20% coinsurance, you pay 20% of the cost of covered services. Your insurance pays the other 80%. Let’s say your brand-name medication costs £400 after your insurer negotiates a rate (this is called the “allowable amount”). Your coinsurance is 20%. You pay £80. Your insurer pays £320. Simple math. But here’s where people get tripped up: coinsurance applies to every single service after your deductible. That includes hospital stays, surgeries, and specialist visits. If you need a costly treatment, your coinsurance adds up fast. Some plans use coinsurance for brand-name drugs and copays for generics. Others have tiered drug lists. Tier 1 (generics) = £10 copay. Tier 3 (specialty drugs) = 30% coinsurance. Always check your plan’s drug formulary. It’s not just about price - it’s about how you pay for it.

Out-of-Pocket Maximum: Your Safety Net

This is the most important number you need to know. Your out-of-pocket maximum is the most you’ll pay in a year for covered services - including deductibles, copays, and coinsurance. Once you hit it, your insurance pays 100% of everything else for the rest of the year. In 2025, the federal cap for individual plans is £8,700. For families, it’s £17,400. These numbers go up slightly each year. But here’s the key: premiums don’t count toward this limit. Only what you pay when you get care does. If you have a chronic condition and take several expensive meds, hitting your out-of-pocket max might take months. But once you do, your monthly prescription costs drop to zero. That’s why it’s worth tracking your spending. Many insurers have apps that show your progress toward this limit. Use them.How These Pieces Work Together

Let’s say you have a silver plan with a £2,000 deductible, £30 copay for primary care, 20% coinsurance, and a £8,700 out-of-pocket max. - January: You visit your doctor for a cough. Copay: £30. You haven’t met your deductible yet, so this £30 doesn’t count toward it. Your insurer covers the rest. - March: You get a new prescription for a £500 drug. You pay £500 because you haven’t met your deductible. That £500 now counts toward your £2,000 deductible. - June: You’ve spent £1,800 on meds and doctor visits. You’re £200 from your deductible. You need a specialist visit. The bill is £600. You pay £200 to hit your deductible. Then, you pay 20% of the remaining £400 = £80. Total for this visit: £280. - November: You’ve spent £8,500 total on care. You get a surgery costing £3,000. You pay £200 to hit your max. The insurer pays the rest. For the rest of the year, your meds, tests, and visits cost you £0. That’s how it flows. Deductible first. Then coinsurance. Copays might stack on top - or not. It depends on your plan.What Plans You Should Choose

Not all plans are made equal. Here’s how to match your plan to your needs:- High-deductible plans (HDHPs): Lower monthly premiums. You pay more up front. Best for healthy people who rarely need care. Often paired with HSAs (Health Savings Accounts), which let you save pre-tax money for medical costs.

- Platinum plans: High premiums, low deductibles. Best for people on multiple chronic meds or who need frequent care. You pay more each month, but your out-of-pocket costs stay low.

- Bronze and silver plans: Middle ground. Bronze has higher deductibles, silver is more balanced. Most people on the marketplace pick silver because of subsidies.

How to Avoid Surprises

Most people get shocked by bills because they didn’t check three things:- Is the provider in-network? Going out-of-network can triple your coinsurance. Always confirm before booking.

- What’s the copay or coinsurance for your specific drug? Call your pharmacy or check your plan’s formulary online. Don’t assume your old med is still cheap.

- What’s your progress toward your out-of-pocket max? If you’re close, schedule non-urgent care before year-end. You’ll save money.

Jason Jasper on 25 December 2025, AT 19:11 PM

Just wanted to say this is the clearest breakdown I’ve ever read. I used to dread opening any medical bill, but now I actually check my insurer’s app every month. Knowing how much I’ve spent toward my out-of-pocket max feels like tracking a savings goal. Small wins, you know?