When you fill a prescription for a generic drug, you might assume the insurance company pays a low, straightforward price-after all, generics are supposed to be cheap. But here’s the truth: what your insurer actually pays isn’t always what it looks like on the receipt. Behind the scenes, a tangled system of hidden fees, spread pricing, and opaque rebates is quietly shaping how much your plan spends-even on a $2 bottle of lisinopril.

Generics don’t get rebates like brand-name drugs

Most people think rebates are how drug prices get lowered. That’s true for brand-name drugs. Companies like Pfizer or Merck pay big rebates-sometimes 30% to 70% of the list price-to pharmacy benefit managers (PBMs) like CVS Caremark or Express Scripts. In return, those PBMs put the brand drug on the preferred tier of the insurance formulary, making it easier for patients to get it covered.But generics? They don’t work that way. There’s no big rebate system because there’s no monopoly. Dozens of companies make the same generic version of metformin or atorvastatin. The price is already low-often under $5 for a 30-day supply. So instead of negotiating rebates, PBMs negotiate direct price concessions or, worse, use something called spread pricing.

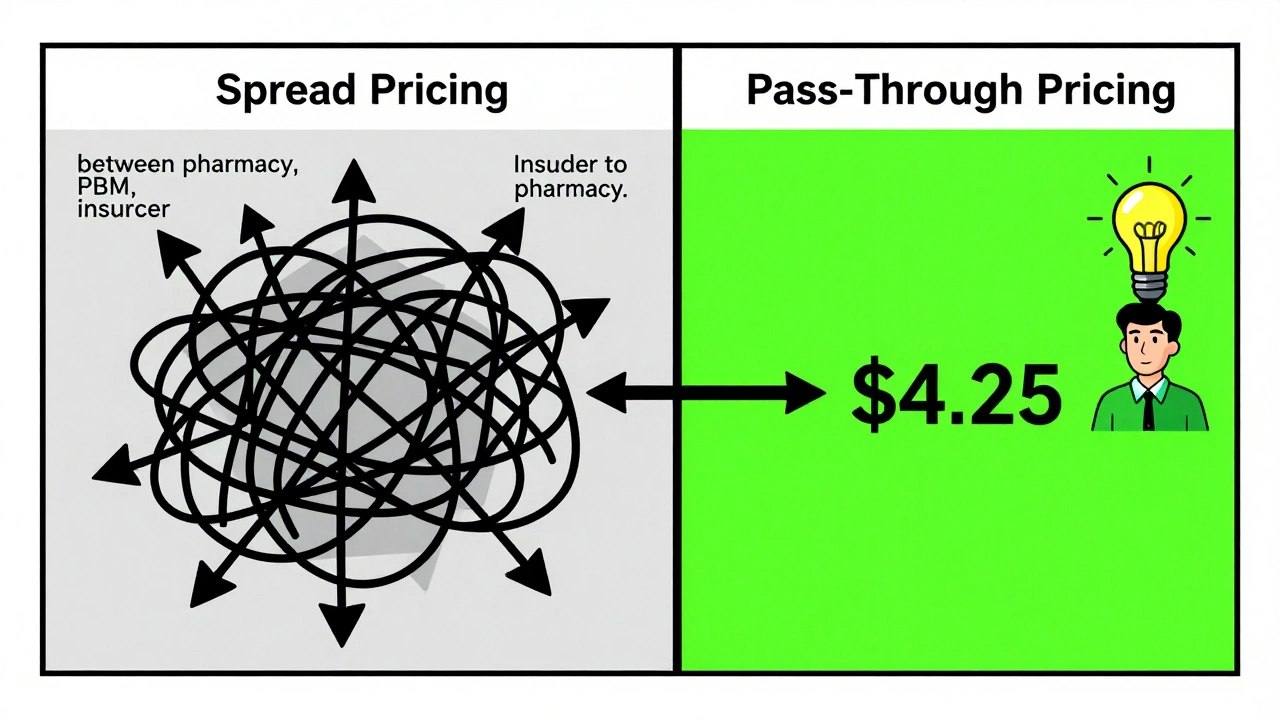

Spread pricing is where the real money hides

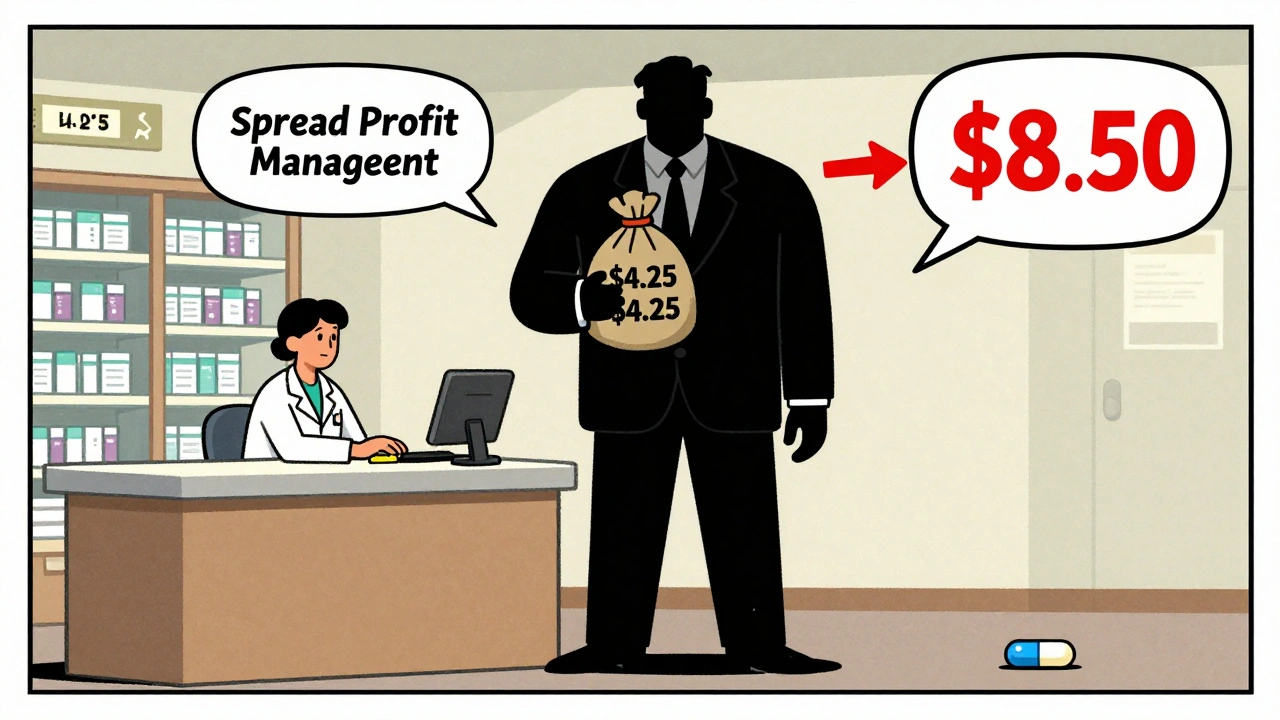

Here’s how spread pricing works: Your insurer agrees to pay the PBM $8.50 for a generic prescription. The PBM then pays the pharmacy $4.25. The $4.25 difference? That’s profit for the PBM. No rebate. No transparency. Just a hidden markup buried in the contract.This isn’t rare. According to the U.S. Department of Health and Human Services, the average spread on generic prescriptions in 2022 was $4.73 per script. Multiply that by millions of prescriptions a year, and you’re talking billions in hidden fees. Employers who self-insure their employees’ health plans often don’t even realize this is happening-until they get their annual drug cost report and see a spike in spending on generics.

One Fortune 500 HR director told Becker’s Hospital Review in 2024 that their PBM was charging $8.50 per generic script while paying pharmacies just $4.25. They had no idea. No disclosure. No audit rights in their contract. That’s not an anomaly-it’s standard practice in many legacy PBM agreements.

Why do PBMs avoid generics? Because they make less money

It sounds backwards, but PBMs often have an incentive to push more expensive brand-name drugs-even when cheaper generics exist. Why? Because brand-name drugs come with big rebates. A 60% rebate on a $100 drug means $60 goes back to the PBM. A $0.15 generic? No rebate. Zero.Rightway Healthcare found in 2023 that PBMs sometimes exclude low-cost generics from formularies to favor higher-rebate brand drugs. One case from the Midwest Manufacturers Association showed a PBM blocking a $0.15 generic in favor of a $5 brand-name drug with a 60% rebate. Net result? The insurer paid more-even with the rebate.

This isn’t just about profit. It’s about perverse incentives. PBMs are paid based on how much they save insurers. But if they’re earning more from rebates on expensive drugs than from the actual cost of generics, they’ll design formularies that hurt patients and inflate costs.

What does insurance actually pay for a generic?

Let’s break it down with a real example. You’re on a typical employer plan. Your copay for a generic blood pressure pill is $10. The pharmacy charges the PBM $4.25. The PBM charges your insurer $8.50. The insurer pays $8.50, you pay $10. The pharmacy gets $4.25. The PBM pockets $4.25. The drugmaker? They got paid $4.25 at the wholesale level and didn’t pay a rebate because there’s no need.So what did the insurer pay? $8.50. But you, the patient, paid $10. The pharmacy got $4.25. The PBM got $4.25. And the manufacturer? They got paid once, at the wholesale level. No rebate. No clawback. No transparency.

Now imagine this happens 10,000 times a month. That’s $42,500 in hidden fees going to the PBM. And your employer’s health plan? They think they’re saving money because they’re using generics. They’re not. They’re just paying more than they should.

The system is changing-but slowly

More employers are catching on. In 2020, only 18% of large employers used pass-through pricing for generics-where the PBM charges a flat administrative fee and passes the actual drug cost straight through. By 2024, that number jumped to 42%, according to the National Business Group on Health.Pass-through pricing means no spreads. No hidden fees. You pay what the pharmacy pays, plus a clear fee. It’s transparent. It’s fair. And it’s the only way to know what your insurance is really spending.

Regulators are watching too. The No Surprises Act of 2020 started pushing for more PBM transparency. The Biden administration’s 2024 Executive Order specifically asked HHS to look at practices that limit generic use. And in 2025, the Centers for Medicare & Medicaid Services (CMS) confirmed that Medicare drug price negotiations-now covering 15 brand-name drugs-still exclude generics, because they’re already competitive.

But the biggest change might come from legislation. The Employee Benefit Research Institute predicts that by 2026, federal rules will require PBMs to fully disclose the actual acquisition cost of every generic drug. That means no more hiding spreads. No more secret profits.

What you can do about it

If you’re an employee: Ask your HR department if your plan uses pass-through pricing for generics. If they don’t know, that’s a red flag.If you’re an employer or plan sponsor: Demand a full audit of your PBM contract. Look for terms like “spread pricing,” “administrative fee,” and “rebate pass-through.” If they won’t show you the actual cost of generics, switch.

If you’re a patient: Don’t assume your copay is the full cost. Sometimes, paying cash at the pharmacy is cheaper than using insurance-especially if your insurer’s PBM is pocketing the spread. Check GoodRx or SingleCare before you swipe your card.

Why this matters

Generics make up 90% of all prescriptions in the U.S. but only 23% of total drug spending. That’s the power of competition. But when PBMs game the system with hidden fees, that savings disappears. The result? Health plans pay more. Employers pay more. Patients pay more.The system was designed to lower costs. Instead, it’s become a black box where money vanishes between the pharmacy, the PBM, and the insurer. And the people who pay the price? You.

Transparency isn’t just nice to have. It’s the only way to fix this.

Do generic drugs have rebates like brand-name drugs?

No, generics typically don’t have rebates. Brand-name drugs come with large rebates-often 30% to 70%-because manufacturers use them to get preferred placement on insurance formularies. Generics, however, are produced by many companies at low prices, so there’s no need for rebates. Instead, pharmacy benefit managers (PBMs) often use spread pricing, where they charge insurers more than they pay pharmacies, keeping the difference as profit.

What is spread pricing and how does it affect generic drug costs?

Spread pricing is when a PBM charges an insurance plan one price for a generic drug but pays the pharmacy a lower amount, pocketing the difference. For example, if the insurer pays $8.50 and the pharmacy gets $4.25, the PBM keeps $4.25. This hidden fee inflates what insurers pay and makes it impossible to know the true cost of generics. In 2022, the average spread on a generic prescription was $4.73, according to the U.S. Department of Health and Human Services.

Why would a PBM prefer a brand-name drug over a cheaper generic?

Because brand-name drugs offer big rebates-sometimes 60% or more-while generics offer none. A PBM earns more from a $100 brand drug with a $60 rebate than from a $0.15 generic. This creates a financial incentive to exclude low-cost generics from formularies, even when they’re clinically identical. Studies show this practice can lead to higher overall drug spending despite the appearance of savings.

How can I find out what my insurance really pays for generics?

If you’re an employee, ask your HR team if your plan uses pass-through pricing, where the PBM charges a flat fee and passes the actual drug cost directly through. If you’re an employer, request a full audit of your PBM contract and demand disclosure of the acquisition cost for generics. You can also compare your copay to cash prices on apps like GoodRx-sometimes paying out of pocket is cheaper than using insurance due to hidden spreads.

Is there any movement to fix this system?

Yes. More employers are switching to pass-through pricing-42% in 2024, up from 18% in 2020. The Biden administration has directed HHS to examine practices that limit generic use. And by 2026, federal rules are expected to require PBMs to fully disclose the actual cost of generic drugs. This will end spread pricing and make the system fairer for everyone.

Deborah Andrich on 13 December 2025, AT 10:46 AM

This is why my copay for lisinopril is $10 but I saw a cash price of $3 at Walmart. No one tells you this stuff. The system is rigged.