What GoodRx Actually Does (And Why It’s Not Insurance)

You walk into the pharmacy with a prescription for your diabetes medication. The pharmacist scans it, and says, "Your insurance copay is $700." You freeze. That’s more than your rent this month. Then they add, "But if you pay cash, it’s $578." You ask how. That’s where GoodRx comes in.

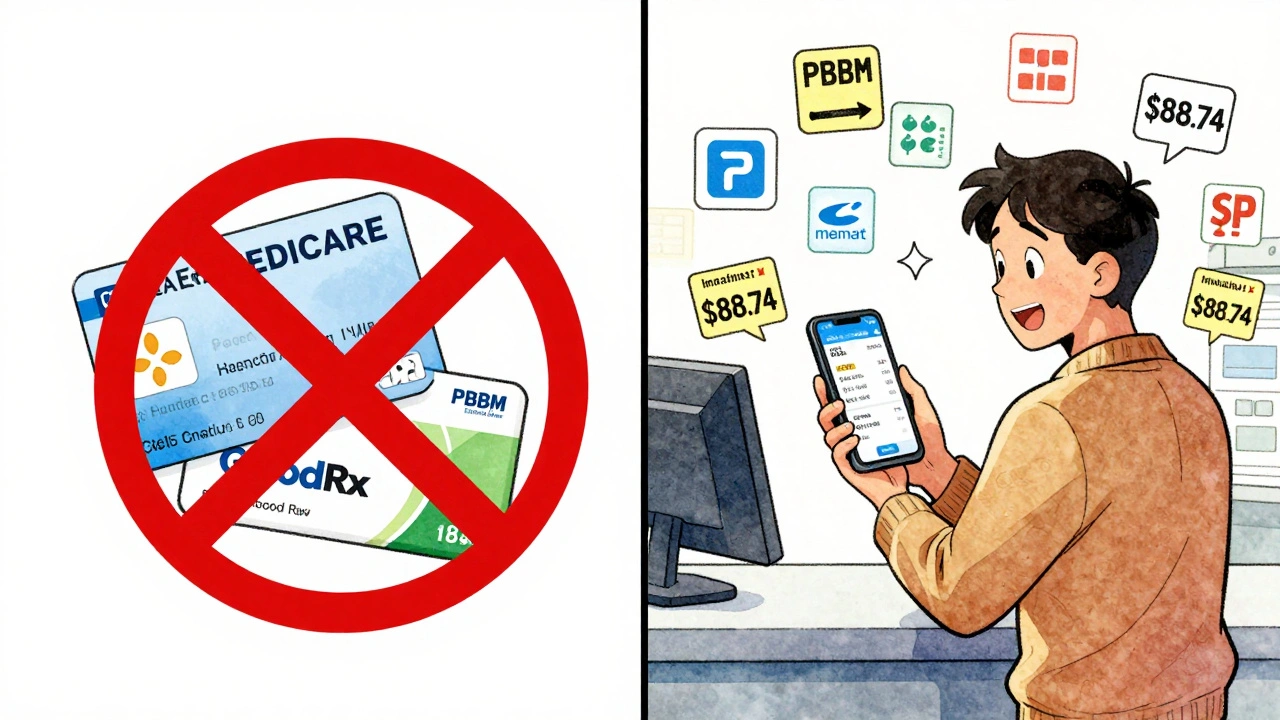

GoodRx isn’t insurance. It doesn’t cover you. It doesn’t negotiate your plan. It doesn’t even know your name. What it does is simple: it shows you the lowest cash price for your drug at nearby pharmacies. It finds deals hidden in the system-discounts meant for insurance networks-and lets you use them as a regular person paying out of pocket.

Think of it like a coupon app for medicine. But instead of $1 off cereal, it’s $600 off a monthly pill. And unlike insurance, there’s no monthly fee, no deductible, no paperwork. Just open the app, type in your drug, and see what pharmacies charge.

How GoodRx Finds These Crazy Low Prices

The secret isn’t magic. It’s data.

GoodRx partners with Pharmacy Benefit Managers (PBMs)-the middlemen that negotiate drug prices for big insurers like UnitedHealthcare and CVS Caremark. These PBMs have contracts with pharmacies that let them offer discounted rates to insured patients. But here’s the catch: those same discounted prices aren’t always available to people paying cash.

GoodRx gets access to those hidden PBM rates and passes them along to you. For example, a 30-day supply of imatinib (a generic cancer drug) might cost $7,666 at full retail in Minneapolis. GoodRx shows you it’s $88.74 at a nearby Walmart. That’s not a typo. That’s the PBM’s negotiated rate.

It updates prices hourly. It covers over 6,000 medications. And it works at more than 70,000 pharmacies across the U.S.-including CVS, Walgreens, Walmart, and Kroger. You don’t need to be a member. You don’t need to sign up. Just show the barcode on your phone at checkout.

When GoodRx Beats Insurance (And When It Doesn’t)

Here’s the real question: should you use GoodRx instead of your insurance?

The answer? Sometimes yes. Sometimes no. It depends on your plan.

If you’re on Medicare Part D and your drug isn’t on your plan’s formulary, GoodRx can save you hundreds. One user paid $700 for Jardiance through Medicare. GoodRx showed $578. That’s a $122 win.

Same thing if you haven’t met your deductible yet. Say your plan has a $2,000 deductible and you’re still early in the year. Your insulin copay is $150. GoodRx shows $98. Pay cash. Save the $150 for later when you need it more.

But here’s where it gets tricky. If your insurance covers your drug at a low copay-say $10 for a generic-then GoodRx won’t help. In fact, using it might hurt you. Some plans count insurance payments toward your out-of-pocket maximum. Cash payments don’t. So if you use GoodRx for a $10 drug, you’re not moving closer to your coverage limit.

And for specialty drugs? GoodRx can backfire. A $1,200 monthly drug like Jardiance might cost $900 through Medicare’s coverage gap phase. GoodRx Gold? Still $1,200. That’s why you always check both.

GoodRx Gold: Is the Subscription Worth It?

GoodRx isn’t just free anymore. There’s GoodRx Gold: $9.99 a month for individuals, $19.99 for families.

What do you get? Deeper discounts-up to 90% off on some meds. Free home delivery. Access to 38,000+ pharmacies. And a few extra perks like telehealth visits for $19.

Is it worth it? Only if you’re taking multiple prescriptions regularly. Say you’re on three generics: one for blood pressure, one for cholesterol, one for thyroid. Without Gold, you’re paying $45, $38, and $22. With Gold, you’re paying $15, $12, and $8. That’s $72 saved per month. Pay for Gold in under two weeks. After that? Pure profit.

But if you only need one drug a month? Skip it. The free version works fine. Gold isn’t for occasional users. It’s for people who live and breathe pharmacy lines.

The Big Problems: Pharmacies That Won’t Accept It

GoodRx sounds perfect-until you get to the pharmacy.

Not all pharmacies accept it. Only about 65% of independent pharmacies will honor the coupon. Chain stores? Usually fine. But smaller, local shops? They might say no. One user in Tennessee got turned away at a Rite Aid because the pharmacist didn’t know how to process it.

And then there’s the paperwork mess. If you show your Medicare card and your GoodRx coupon at the same time, you could get flagged. Medicare rules say you can’t combine the two. If you accidentally do, your coverage could be at risk. One in five cases like this trigger an investigation.

Worse? Some drugs just don’t qualify. Controlled substances like Adderall? No discounts. Brand-name biologics? Rarely. And if your drug is new? GoodRx might not have the price yet.

Alternatives: SingleCare, RxSaver, Amazon Pharmacy

GoodRx isn’t the only game in town.

SingleCare is close behind. It’s cheaper for some drugs, and it lets you book telehealth visits for $10. But it doesn’t update prices in real time like GoodRx. You might see $120 for a drug, only to find out at the counter it’s $140.

RxSaver is simpler. Less clutter. Good for quick lookups. But it covers fewer pharmacies and doesn’t have the same depth of data.

Then there’s Amazon Pharmacy. Launched in 2020, it offers discounts on generics and free two-day shipping. For some drugs, it’s 8-12% cheaper than GoodRx. But it only works if you’re an Amazon Prime member. And it doesn’t compare prices across pharmacies. You’re locked into Amazon’s own pricing.

Bottom line? Try all three. Run the same prescription through each app. The one with the lowest price wins. No loyalty needed.

How to Use It Without Getting Screwed

Here’s how to use GoodRx right:

- Before you fill your prescription, open the app and search your drug. Write down the lowest price.

- Ask your pharmacist: "What’s my insurance copay?" Then say: "Can you check the cash price using this coupon?"

- If the cash price is lower, pay cash. Don’t use insurance.

- If the insurance price is lower, use insurance.

- Never show both your insurance card and GoodRx coupon at the same time.

- For Medicare users: always check your Explanation of Benefits (EOB) statement to see what you actually paid.

Pro tip: If the pharmacist says "We don’t take GoodRx," ask if they can call the GoodRx hotline. Most of the time, they’ll find a way. It’s not that they won’t accept it-they just don’t know how.

Why This System Even Exists

GoodRx didn’t invent drug price chaos. It just exposed it.

The U.S. has no national drug pricing system. Insurers, PBMs, pharmacies, and manufacturers all negotiate separately. That’s why the same pill can cost $5 at one pharmacy and $500 at another. GoodRx just shines a light on the worst parts.

Experts like Dr. Adam Amdur say it helps 87% of generic prescriptions. But others, like Dr. Aaron Kesselheim, warn it might be making prices worse. PBMs, he says, raise list prices knowing GoodRx will cut them down. So the sticker price climbs, and the discount gets bigger-but the real cost? Still rising.

It’s a bandage on a broken system. But if you’re paying out of pocket? It’s the best bandage we’ve got.

What to Do Next

Don’t just assume your insurance is the best option. Not anymore.

Next time you get a prescription, do this:

- Open GoodRx.

- Search your drug.

- Compare it to your insurance copay.

- Pay the lower one.

It takes two minutes. It could save you hundreds. And if you’re on Medicare, on a high-deductible plan, or just broke? It’s not optional. It’s essential.

And if you’re using GoodRx? Don’t feel guilty. You’re not gaming the system. You’re just using the tools available to you. In a broken market, that’s not cheating. That’s survival.

Can I use GoodRx with Medicare?

Yes, but only if you’re paying cash. You cannot use GoodRx and your Medicare card at the same time. If you do, you risk triggering a fraud investigation. Always choose one or the other. If your Medicare copay is higher than the GoodRx price, pay cash and save money. But remember: cash payments don’t count toward your Medicare out-of-pocket maximum.

Why is GoodRx cheaper than my insurance?

GoodRx accesses the same discounted rates that insurance companies negotiate with pharmacies-but it passes those savings directly to you. Insurance companies often have high copays because of deductibles, formulary tiers, or rebates that don’t benefit you. GoodRx cuts out the middleman and gives you the pharmacy’s lowest cash price, which is sometimes lower than what your insurance charges.

Does GoodRx work for all medications?

No. GoodRx doesn’t offer discounts on controlled substances like Adderall, Xanax, or opioids due to DEA rules. It also doesn’t work well for very new or specialty drugs, especially biologics like Humira or Enbrel. For those, manufacturer coupons or patient assistance programs may be better options. Always check the app first-it’ll tell you if a discount is available.

Is GoodRx Gold worth the monthly fee?

Only if you take multiple prescriptions every month. For one or two drugs, the free version is enough. But if you’re on three or more generics, Gold can save you $50-$100 a month. At $9.99/month, that’s a net gain. It’s also useful if you want free home delivery or access to telehealth visits. But if you rarely refill prescriptions, skip it.

Why do some pharmacies refuse GoodRx?

Some independent pharmacies don’t participate in the PBM networks GoodRx uses. Others don’t have the staff trained to process the coupons. It’s not that they’re refusing you-it’s that their systems aren’t set up for it. Always call ahead or ask the pharmacist to call GoodRx’s support line. Most times, they can make it work.

matthew dendle on 11 December 2025, AT 16:28 PM

goodrx is just a bandaid on a system that got amputated and then sold the leg as a collectiblethey make you feel smart for using it but honestly you're just paying the price the system wants you to pay after they jack it up first

also why does walmart have $88 for imatinib but my local pharmacy charges $1200 like i'm stealing from the pope