When you pick up a prescription, the price you pay at the pharmacy isn’t the full cost of the drug. It’s your copay-the portion you owe after your insurance kicks in. But here’s the thing: that number can be wildly different depending on whether you’re getting a generic or brand-name drug. In 2024, the gap between these two isn’t just noticeable-it’s massive. And if you’re on Medicare or have commercial insurance, understanding this difference could save you hundreds-or even thousands-of dollars a year.

How Copay Tiers Work in 2024

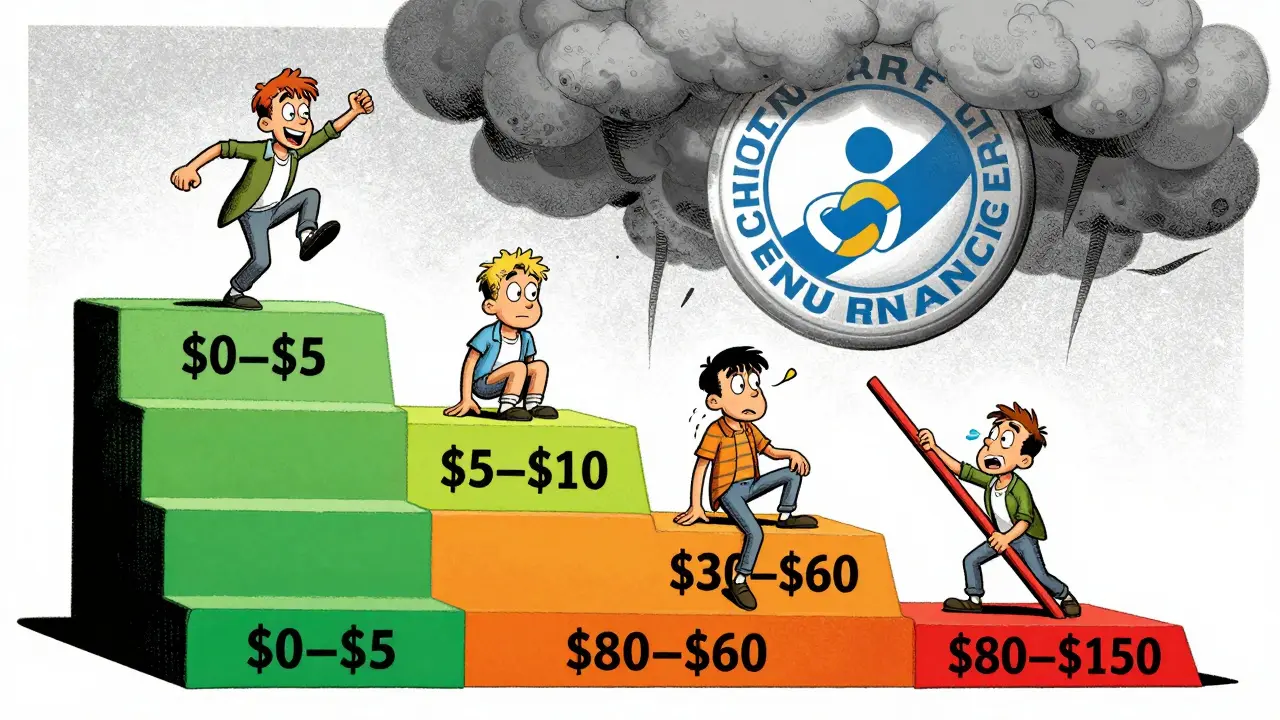

Most prescription drug plans, whether through Medicare or private insurance, use a tiered system. Think of it like a pricing ladder. The lower the tier, the cheaper your copay. In 2024, most plans have four main tiers:- Tier 1: Preferred Generic - The cheapest option. Often $0 to $5.

- Tier 2: Non-Preferred Generic - Slightly higher, usually $5 to $10.

- Tier 3: Preferred Brand - Brand-name drugs your plan encourages. Copays range from $30 to $60.

- Tier 4: Non-Preferred Brand - Brand drugs your plan doesn’t push. These can cost $80 to $120 or more.

What You’ll Actually Pay in 2024

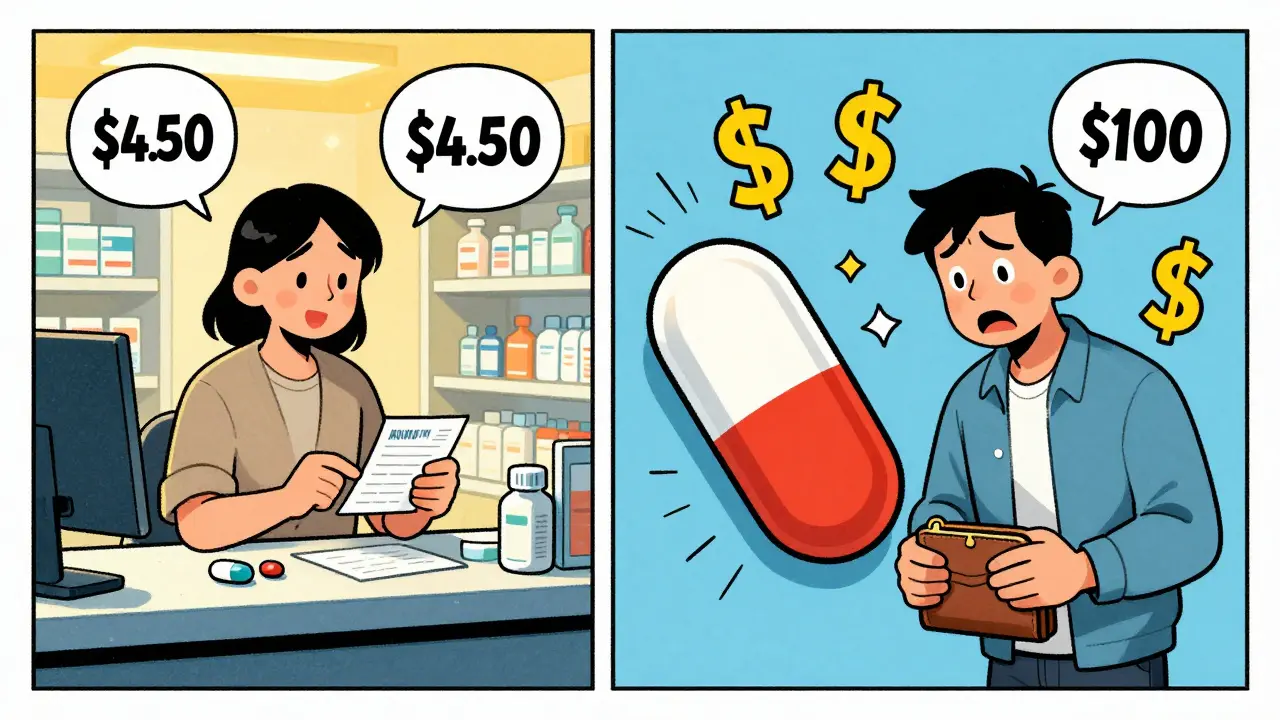

Let’s get specific. Based on data from Medicare Part D plans and major insurers like Blue Cross Blue Shield, here’s what the average copay looked like in 2024:| Drug Type | Average Copay (MA-PD Plans) | Average Copay (PDP Plans) |

|---|---|---|

| Preferred Generic | $4.50 | 22% coinsurance (often $3-$8) |

| Non-Preferred Generic | $7 | 47% coinsurance (often $10-$15) |

| Preferred Brand | $47 | 22% coinsurance (often $30-$60) |

| Non-Preferred Brand | $100 | 47% coinsurance (often $80-$150) |

Medicare Advantage Prescription Drug (MA-PD) plans usually charge fixed copays. Standalone Prescription Drug Plans (PDPs) often use coinsurance-meaning you pay a percentage of the drug’s total price. That’s a big deal. If your brand-name drug costs $300, a 47% coinsurance means you pay $141. But if you’re on an MA-PD plan, you might pay just $100.

For people with low income enrolled in Extra Help, the government capped copays at $4.50 for generics and $11.20 for brand-name drugs in 2024. That’s a lifeline for many.

Why the Huge Price Gap?

Generic drugs are chemically identical to their brand-name counterparts. They’re not cheaper because they’re weaker-they’re cheaper because the patent expired. Once a brand-name drug’s patent runs out, other companies can make the same pill. No need to spend millions on marketing or clinical trials. That’s why generics make up 92.7% of all prescriptions but only 17% of total drug spending. Brand-name drugs, on the other hand, carry the weight of R&D, advertising, and patent protection. A single brand-name drug can cost $1,000 a month. Your insurance plan doesn’t want to pay that-so they make you pay more. That’s why non-preferred brand drugs have the highest copays.

What Happens If You Choose a Brand Over a Generic?

Some plans have a nasty trick called “Member Pay the Difference.” Here’s how it works: If your doctor prescribes Lipitor (brand), but a generic version (atorvastatin) is available and covered, your plan will only pay for the generic’s cost. You’re on the hook for the rest. Say Lipitor costs $120, and the generic costs $15. Your plan covers $15. You pay $105 extra. Even if your doctor writes “dispense as written,” your plan doesn’t care. You still pay the difference. This isn’t rare. In 2024, over 60% of commercial plans used this policy. One Reddit user, u/PharmaPatient, shared: “I got stuck paying $42 extra just because my doctor chose the brand. I didn’t even know this was a thing until I got the bill.”Medicare’s Big Changes Coming in 2025

The Inflation Reduction Act didn’t just tweak copays-it’s rewriting the rules. Starting January 1, 2025:- All Medicare Part D plans must cap your out-of-pocket drug spending at $2,000 per year.

- Preferred generic copays will be $0 for 98% of plans-up from 87% in 2024.

- Insulin will still cost no more than $35 a month, no matter the brand.

This means if you’re taking multiple brand-name drugs, your total cost could drop by nearly 30% compared to 2023. But here’s the catch: non-preferred brand copays are expected to rise to $105 on average. So even though your cap is lower, the cost per pill might go up.

How to Find Your Real Costs

You can’t guess your copay. You have to check. Every year by October 15, your plan must publish its formulary-the official list of drugs and their tiers. Use the Medicare Plan Finder to enter your exact medications. It shows you exactly what you’d pay under each plan. Don’t just look at monthly premiums. Look at drug costs.One Medicare counselor told me: “A plan with a $5 generic copay but $100 brand copay might cost you $1,200 a year for one brand drug. A plan with $0 generics and $40 brand copays might cost only $480.”

And if you’re on multiple meds? Add them all up. A $10 generic copay on five drugs is $600 a year. A $100 brand copay on two drugs is $2,400. That’s not a small difference-it’s life-changing.

What to Do If You Can’t Afford Your Meds

If you’re struggling:- Ask your doctor for a generic alternative. In 2024, 72% of Medicare plans offered a preferred generic for at least 80% of common brand drugs.

- Check if your drug is on a lower tier. Sometimes switching to a different brand drug (not generic) cuts your cost.

- Apply for Extra Help if your income is low. It’s not just for Medicaid recipients.

- Use SingleCare or GoodRx for cash prices. Sometimes paying cash is cheaper than your copay.

- Request a formulary exception. If a generic doesn’t work for you, your doctor can appeal to your plan.

The Medicare Rights Center found that 63% of people on brand-name drugs struggled to afford them in 2024. Only 28% of generic users did. That gap isn’t about choice-it’s about design.

Final Thought: It’s Not About Saving a Few Dollars

This isn’t just about picking the cheapest pill. It’s about whether you’ll be able to take your medicine next month. A $10 copay sounds small. But if you’re paying $100 for a brand drug every month, that’s $1,200 a year. That’s rent. That’s groceries. That’s your gas to get to your next appointment.Generic drugs work. They’re safe. They’re effective. And in 2024, they’re cheaper than ever. If your doctor pushes a brand name without explaining why, ask: “Is there a generic?” Don’t assume it’s not an option. Ask. Push. Check. Because the system is built to make you pay more. But you don’t have to.

What’s the average copay for generic drugs in 2024?

In 2024, the average copay for preferred generic drugs under Medicare Part D was $4.50, and many plans had $0 copays. Non-preferred generics averaged $7. Commercial plans often used coinsurance, typically 10-20% of the drug’s cost, which often came to $3-$15 per prescription.

Why are brand-name drug copays so much higher than generics?

Brand-name drugs are expensive because manufacturers recover research, development, and marketing costs during their patent period. Once the patent expires, generics enter the market and can be sold at a fraction of the price because they don’t need to repeat costly clinical trials. Insurance plans incentivize generics by making them cheaper-sometimes drastically so-to reduce overall spending.

Can I be charged extra for choosing a brand over a generic?

Yes. Many plans use a policy called “Member Pay the Difference.” If a generic version is available and your doctor prescribes the brand, your insurance will only cover the cost of the generic. You pay the difference between the brand and generic price-on top of your regular copay. For example, if the brand costs $120 and the generic is $15, you pay $105 extra.

Will my copays change in 2025?

Yes. Starting in 2025, Medicare Part D will cap your total out-of-pocket drug spending at $2,000 per year. Preferred generic copays will drop to $0 for nearly all plans. Non-preferred brand copays are expected to rise to $105 on average, but your annual cap means you won’t pay more than $2,000 total-even if you’re on expensive medications.

How do I find the best drug plan for my medications?

Use the Medicare Plan Finder tool and enter every medication you take, including dosage and frequency. Compare plans side by side based on total annual drug costs-not just monthly premiums. Look for plans that put your drugs on lower tiers. If you take multiple brand-name drugs, prioritize plans with lower brand copays, even if generics cost a bit more.

Are cash prices ever cheaper than my copay?

Yes, often. For some generic drugs, the cash price through services like GoodRx or SingleCare can be lower than your insurance copay. For example, a 30-day supply of metformin might cost $10 cash but $15 with your copay. Always check before you pay at the counter.

If you’re taking regular medications, don’t wait until you get a bill you can’t afford. Review your plan’s formulary every fall. Talk to your pharmacist. Ask your doctor about alternatives. Small choices now can mean big savings later.

Tim Goodfellow on 18 December 2025, AT 21:16 PM

Wow. This is the kind of post that makes you realize the system is rigged. I didn’t know generics were 92% of prescriptions but only 17% of spending. That’s not just smart-it’s revolutionary. I’m switching everything to generics starting next month. My wallet will thank me.